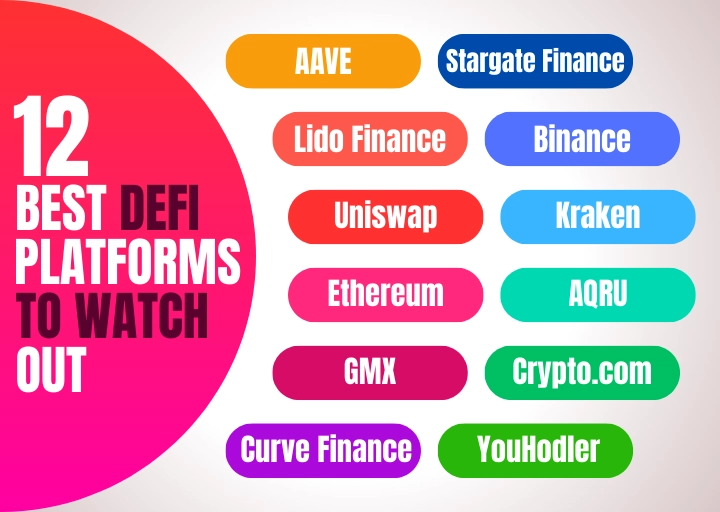

12 Best Defi Platforms To Watch Out in 2025

DeFi, which is short for Decentralized Finance, has revolutionized a large part of the financial world by delivering its new financial viewpoint. Almost time to step into 2025, and it seems that DeFi platforms will fill in more space. The old form of the financial sector is changing, and probabilities are appearing. So, before talking about the best DeFi platforms, let’s first understand what DeFi is, actually.

DeFi is a revolutionary financial ecosystem built on blockchain that seeks to recreate and evolve traditional financial services while eliminating all centralized authority. Being decentralized and transparent, the networks are accessible and inclusive to all around the globe. Through smart contracts, DeFi platforms execute functions including lending, trading, and staking in an autonomous and secure manner.

Removing the intermediaries, DeFi empowers the users to remain in control of their assets and minimize counterpart risks and achieves a level playing field. The foundation of DeFi comprises three core pillars: openness, accessibility, and financial enclusivity.

As we progress into 2025, DeFi platforms are proving to be irreplaceable. Increased adoption of DeFi solutions speaks towards its greatness, by making financial transactions clear, safe, and efficient. Quickly, this platform is being approached by people from all walks of life and even investors interested in alternative financial sectors.

Table of Contents:

1. What Are the Basic Requirements You Should Look for in a DeFi Platform?

1.1 Security Features

1.2 User Interface and Experience

1.3 Token Offerings

1.4 Cross-Application Interoperability

2. Top 12 DeFi Platforms

2.1 Aave

2.2 Lido Finance

2.3 Uniswap

2.4 Ethereum

2.5 GMX

2.6 Curve Finance

2.7 Stargate Finance

2.4 Binance

2.5 Kraken

2.7 AQRU

2.4 Crypto.com

2.5 YouHodler

3. Conclusion

What Are the Basic Requirements You Should Look for in a DeFi Platform?

With the growing popularity of DeFi, choosing a legitimate one will be very important for a frictionless and safe operation. Here are the main criteria that need to be considered in DeFi selection:

A. Security Features

Security is the backbone of every reliable DeFi. Seek functionalities like end-to-end encryption, multi-signature wallets, and recurring security audits. The best platforms use advanced technology to protect funds and data from vulnerabilities.

B. User Interface and Experience

A well-designed user interface enhances the overall experience, making it effortless for beginners and experienced users alike. The intuitive design, responsive tools, and streamlined workflows ensure that trading, lending, and staking are done efficiently.

C. Token Offerings

A diversified portfolio of tokens is crucial. Top platforms have multiple tokens for trading, lending, or staking, and the list keeps growing based on users’ needs. This ability to adapt shows a commitment to growth and innovation by the platform.

D. Cross-Application Interoperability

Maximization of utility in DeFi platforms requires interoperability. Seamless integration into other DeFi protocols and blockchain networks allow people to tap into a broader ecosystem, producing collaboration and innovation.

Top 12 DeFi Platforms

1. Aave

Aave is still quite the leader within the DeFi space, unique for innovative lending protocols. Using this Ethereum-based lending and borrowing service creates imperceptible interactivity with smart contracts to guarantee trustless, secure transactions. Aave’s “Earn interest on deposits, borrow against collateral” capability makes the Aave platform highly versatile for diverse financial needs.

2. Lido Finance

Lido offers a distinguished platform with a user-friendly interface and strong security measures. It is decentralized lending and trading, a feature that supports a great number of assets and interest rates competitive in their fields. Having dynamic liquidity pools and advanced trading tools allows Lido to be used both by newcomers and professionals in DeFi for an ultimate rewarding experience.

3. Uniswap

Currently, Uniswap is dominating the DeFi trading space in terms of its ‘automated market maker’ protocol that allows permissionless efficient token swaps. Its DEX model eliminates intermediaries, thereby being transparent with minimal fraud risks. With innovative features such as concentrated liquidity in V3 from Uniswap, the lending and borrowing processes are enhanced and, for these reasons, place it firmly as one of the best DeFi platforms.

4. Ethereum

Having been one of the pioneer products in smart contracts, Ethereum remains a stronghold in DeFi. Despite various problems such as scalability issues and fees associated with transactions, Ethereum will be shifting towards Ethereum 2.0 to correct those problems. Ethereum moves on from being proof-of-work towards proof-of-stake, making it a more scalable form with fees lowered and environmental footprints.

5. GMX

GMX has turned out to be one of the most reliable DeFi lending platforms where users lend and borrow cryptocurrencies in a very transparent way with competitive interest rates. Furthermore, it supports seamless decentralized trading through a wide range of tokens with low fees and great liquidity.

Not to mention, it excels at staking, providing a very user-friendly interface for users with quite attractive rewards. These features make GMX stand out as a platform for lending, trading, and earning passive income in the DeFi ecosystem.

6. Curve Finance

Curve Finance has found a space in the DeFi world with stablecoin trading, where traders can find low slippage and minimal fees. Its AMM model ensures that liquidity pools maintain pegs on the stablecoin efficiently.

This makes Curve Finance the platform for stablecoin transactions as it invites liquidity providers and makes the ecosystem robust for the traders and investors.

7. Stargate Finance

Stargate Finance is a yield aggregator service that maximizes yields by routing user assets to the most profitable strategies. In an auto-compounding mechanism, yields are automatically reinvested, so users get optimal returns with minimal effort.

With diversified investment options like liquidity provision, yield farming, and lending, Stargate Finance caters to a wide range of risk profiles. Its intuitive dashboard and strong security measures further enhance the user experience, making it a promising platform.

8. Binance

Although considered to be a centralized exchange, Binance did excellent in the DeFi space with the Binance Smart Chain, or BSC. BSC is a blockchain network supporting dApps and smart contracts; however, it offers faster transaction times compared with Ethereum as well as has lower fees.

Binance’s system also hosts other very popular DeFi projects like PancakeSwap and Venus, whose native token is BNB. BNB holders get a cost saving on transaction fees and the option to stake, making Binance a leading DEFI project.

9. Kraken

Kraken bridges the gap between traditional and decentralized finance by offering access to DeFi protocols through its centralized platform. Users can engage in decentralized lending, exchanges, and other financial services without navigating multiple platforms.

Kraken has an easy user interface and robust security measures, which makes it an attractive option for new as well as professional traders. Being centralized by nature, yet integrating DeFi protocols, Kraken opens the door to further access and convenience of decentralized finance.

10. AQRU

AQRU is, therefore relatively new in the DeFi staking landscape, providing competitive returns along with an effortless staking experience. Its focus on delivering high yields for passive income seekers makes it, therefore a platform to watch, as the DeFi landscape evolves.

It will depend on how well AQRU actually performs and takes a user-friendly approach to attract and retain its users. Through seamless staking options combined with highly competitive returns, it has the possibility to stand out in such a crowded market.

11. Crypto.com

Crypto.com is the staking platform also further pushing into the DeFi space by offering attractive Annual Percentage Yields, APYs. The variety of cryptocurrencies supported on the platform allows users to diversify their holdings and earn competitive returns.

Crypto.com’s staking platform is accessible for all users, experienced as well as new. Its seamless user experience coupled with its feature set makes it one of the stand-out applications in the DeFi space.

12. YouHodler

YouHodler offers high interest rates for crypto deposits and unique features such as crypto-backed loans. That would allow users to lock in fiat or stablecoins through crypto on deposit as collateral to put liquid cash aside without selling the assets.

The exchange also offers margin trading and Turbo Loans for more professional traders. However, there are concerns raised about the lack of transparency and regional restrictions that an individual should take care to research more about the platform before using.

Conclusion

The DeFi landscape is full of innovation and opportunities. Platforms like GMX, Curve Finance, Stargate Finance, and Binance redefine decentralized finance and showcase a diversified range of services that cater to different needs. Newcomers such as AQRU and YouHodler are competitive options in the market.

As the industry grows, so does Blockchain Studioz, a pioneering DeFi development company that is leading by providing truly innovative solutions to redefine the DeFi experience. Whether an investor, a developer, or a curious enthusiast, these platforms and companies are shaping a whole new future for decentralized finance.

Principal Consultant