What is a Cross Chain Bridge?

The Web3 universe is transforming into a multi-chain world, with decentralized applications (dApps) running on many blockchains and layer-2 solutions. There are different security measures, trust models, and consensus algorithms in each of these blockchains. With blockchain scalability remaining an issue, this phenomenon is likely to continue, with the addition of more independent networks, layer-2 and layer-3 solutions, and application-specific blockchains designed for the specific requirements of decentralized applications.

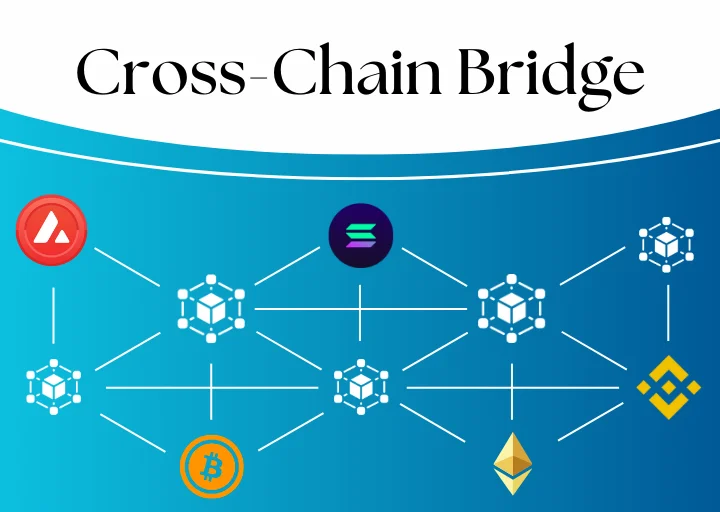

But blockchains are not naturally capable of communicating with each other. This absence of interoperability constrains the complete potential of a multi-chain environment, which makes cross chain messaging protocols inevitable. These protocols allow smart contracts to share information between blockchains, building an integrated Web3 ecosystem.

As blockchain environments expand, cross chain interoperability products are becoming ever more vital. These products enable tokens and data to travel safely between networks, allowing easy communication between segregated blockchains.

Cross chain bridges form a central element of this platform for interoperability, enabling tokens and assets to be transferred from one blockchain to another.

Table of Contents:

1. Why Are Cross Chain Bridges Essential in Web3?

2. How Do Cross Chain Bridges Function?

3. Types of Cross Chain Bridges

4. The Challenges of Cross Chain Bridging

4.1 Security Risks

4.2 Fragmented Data and Obscured Transaction Paths

4.3 Lack of Atomicity in Cross Chain Operations

4.4 Scalability Issues

Cross chain bridges: what are they, what type are there, what are their design challenges, and how are the Cross Chain Interoperability Protocol (CCIP) developers working now to solve those problems?

Why Are Cross Chain Bridges Essential in Web3?

Blockchains exist in solitude, unable to natively observe or talk to activity on other chains. Each blockchain is governed by its own rules, including varying protocol designs, native tokens, programming languages, governance models, and community cultures. This fragmentation prevents cross chain communication, restricting economic activity in Web3. Without interoperability, blockchains are siloed economies, unable to move assets or information.

An easy analogy to get a grasp on cross chain bridges is to liken blockchains to continents divided by huge oceans.

- Continent A is rich in natural resources.

- Continent B is rich in agricultural land.

- Continent C is rich in manufacturing with high-skilled workers.

If these continents were not connected, each would suffer—Continent A would have no food, Continent B would not have the technology to optimize production, and Continent C would have no vital resources for production. But through the creation of trade routes, shipping lanes, and infrastructure, these continents would be able to trade resources, optimize efficiency, and prosper as a whole.

Similarly, cross chain bridges connect different blockchain networks such that every chain is able to focus on its point of strength while utilizing the aggregated strength of the larger network.

How Do Cross Chain Bridges Function?

A cross chain bridge is a decentralized application (dApp) that facilitates asset transfer across different blockchains. Through cross chain liquidity, these bridges enhance token utility as well as use of assets beyond a single blockchain.

Cross chain bridges generally work through smart contracts that:

- Lock or incinerate tokens on the original blockchain.

- Unlock or create equivalent tokens on the target blockchain.

Most cross chain bridges leverage a cross chain messaging protocol for secure and uninterrupted token transfers. Most bridges function as application-specific services between two blockchains.

In addition to straightforward token swaps, some cross chain bridges provide:

- Decentralized exchanges (DEXs) that function across multiple chains.

- Cross chain money markets for lending and borrowing between networks.

- Generalized interoperability for sharing data and calling smart contracts between blockchains.

Types of Cross Chain Bridges

There are three main mechanisms through which cross chain bridges function:

- Lock and Mint – A user locks tokens in a smart contract in the source chain, and a corresponding amount of wrapped tokens is minted in the destination chain as an IOU. Upon reverse transfer, the wrapped tokens are burned, and the original tokens are unlocked on the source chain.

- Burn and Mint – Source chain tokens are burned, and the same native tokens are released (minted) on the destination chain.

- Lock and Unlock – Tokens on the source chain are locked, and an equal value of native tokens is unlocked from a liquidity pool on the destination chain. Such bridges tend to pull liquidity on both sides through economic incentives such as revenue sharing.

In addition to mere asset swaps, cross chain bridges can handle arbitrary data messaging, which is used to carry any form of data across chains. This paves the way for programmable token bridges to perform extra action—like exchange, lending, staking, or token deposits—automatically on the destination chain in a single transaction.

Another classification of cross chain bridges is based on their trust model in confirming transactions between blockchains. The less a cross chain solution relies on trust, the greater the computational overhead, the reduced flexibility, and the less generalizable the solution is. These trade-offs are required to enable use cases that need strong security guarantees.

The Challenges of Cross Chain Bridging

Cross chain bridges, that enable cross-communication and asset transfers between other blockchain networks, are faced with some significant challenges. Overcoming these challenges is vital for cross chain safety and efficiency.

Security Risks

Cross chain bridges are generally an easy victim for design and implementation vulnerability-based attacks. Such attacks were seen at the instance of the Ronin Bridge hack in March 2022 when five out of nine private keys were compromised, evidencing the scale of such attacks.

To defend against such attacks, proper private key management processes have to be in place, i.e., hardware security modules (HSMs), encryption, and multi-signature schemes. Apart from this, conducting a thorough and periodic security audit of smart contracts can also assist in identifying and solving potential vulnerabilities before they are subjected to exploitation.

Fragmented Data and Obscured Transaction Paths

Decentralizing blockchains causes fragmented data in various networks, making cross chain transaction tracking and monitoring complicated. Fragmenting may make the history of transactions unclear, and it is hard to identify criminal activities or comply with regulations while ensuring privacy is not lost.

The necessity of implementing standardized procedures for sharing data across chains and advancing interoperability can mitigate such issues. Adoption of end-to-end monitoring solutions that promote transparency on cross chain operations is also necessary in maintaining transparency and security.

Lack of Atomicity in Cross Chain Operations

Making cross chain operations atomic, i.e., either complete in full or not at all, is the primary challenge. Without atomicity, the risk of partial executions is realized where one part of the transaction executes, and another fails such that the possible losses or inconsistencies are incurred.

For example, a trader could buy an asset on one blockchain and not be able to sell it on another due to the delay or errors in the bridging process.

Having procedures that allow atomic swaps and employing smart contracts that can handle cross chain transactions can make the transactions more stable.

Scalability Issues

While cross chain bridges are intended to enhance scalability through the distribution of transaction loads on multiple blockchains. They themselves suffer from performance bottlenecks. The bottlenecks may be because of limitations in the bridge’s capacity to handle a high number of transactions or due to inefficiency in the base blockchain networks.

Optimization of bridging architecture for performance and support for blockchains offering greater throughput can be beneficial steps to manage scalability problems.

By actively addressing these challenges with robust security, standardized protocols, and optimized architectures. The reliability and efficiency of cross chain bridges can be significantly improved, and more trust and usage can be established in the blockchain space.

Principal Consultant